about us

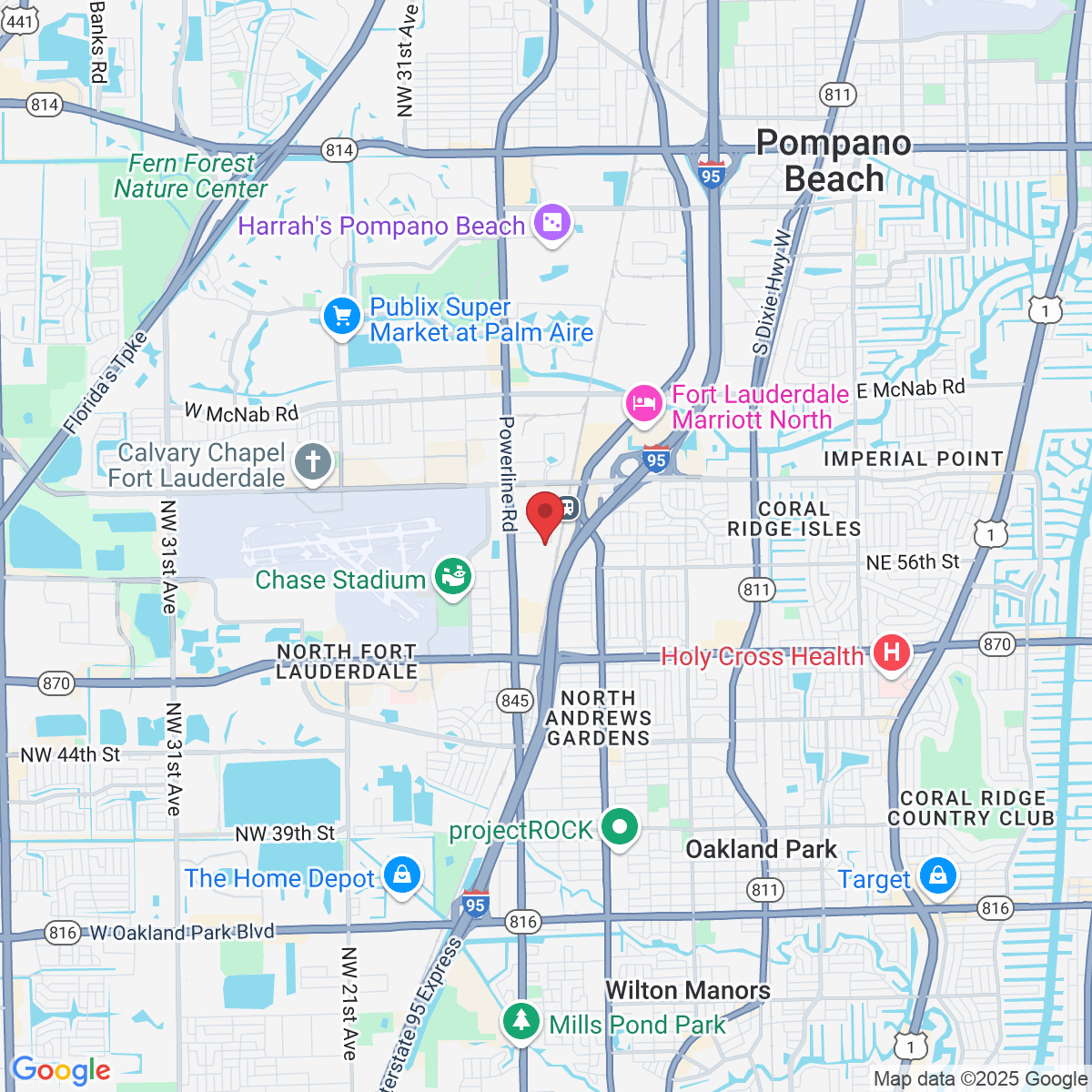

Established by industry experts, Orange Movers is a premier moving company in South Florida, dedicated to ensuring client satisfaction. With over a decade of experience, we've successfully relocated thousands, thanks to our knowledgeable team and modern equipment. We pride ourselves on understanding your needs, making us a trusted partner in your moving journey.